what is suta tax rate for 2021

Lets say your business is in New York where. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee.

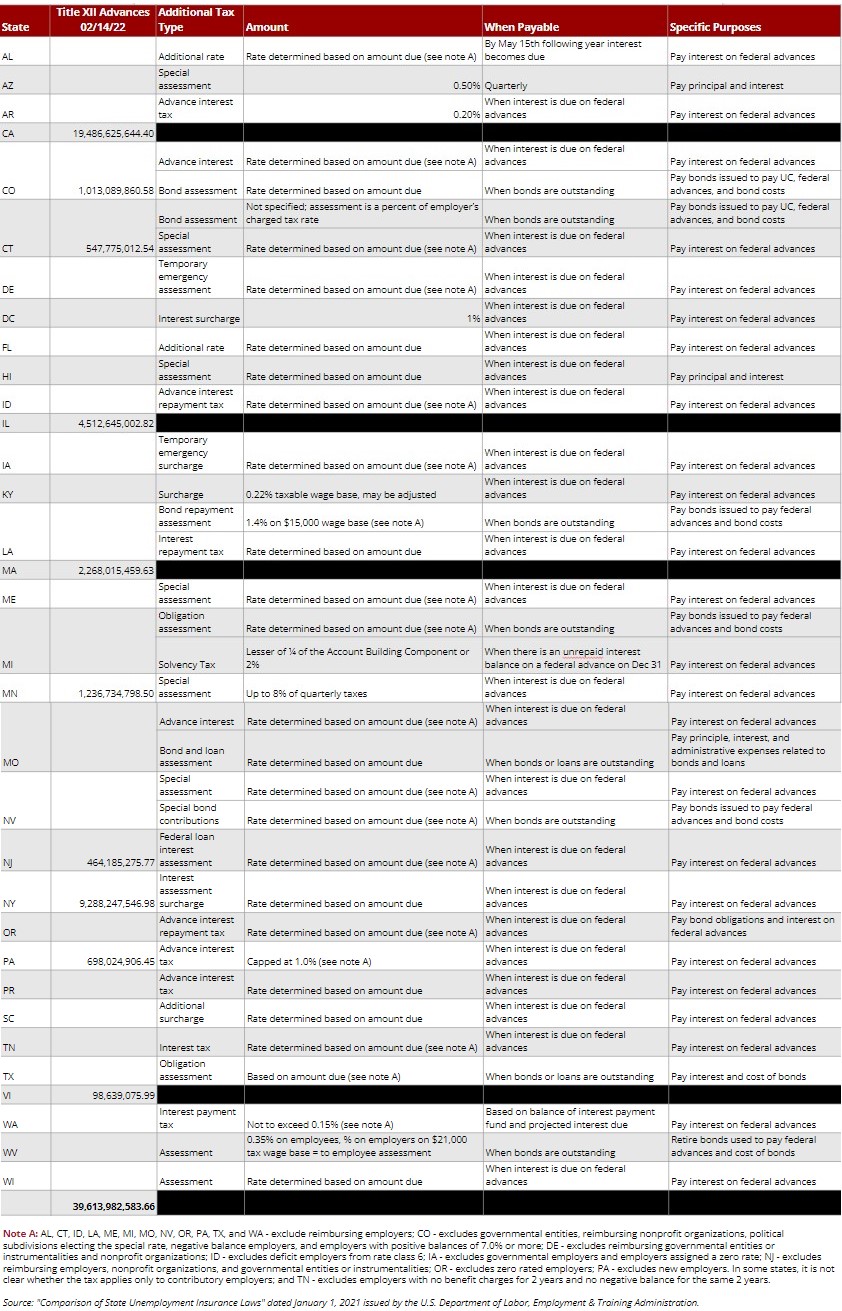

State Unemployment Trust Funds 2021 Unemployment Compensation

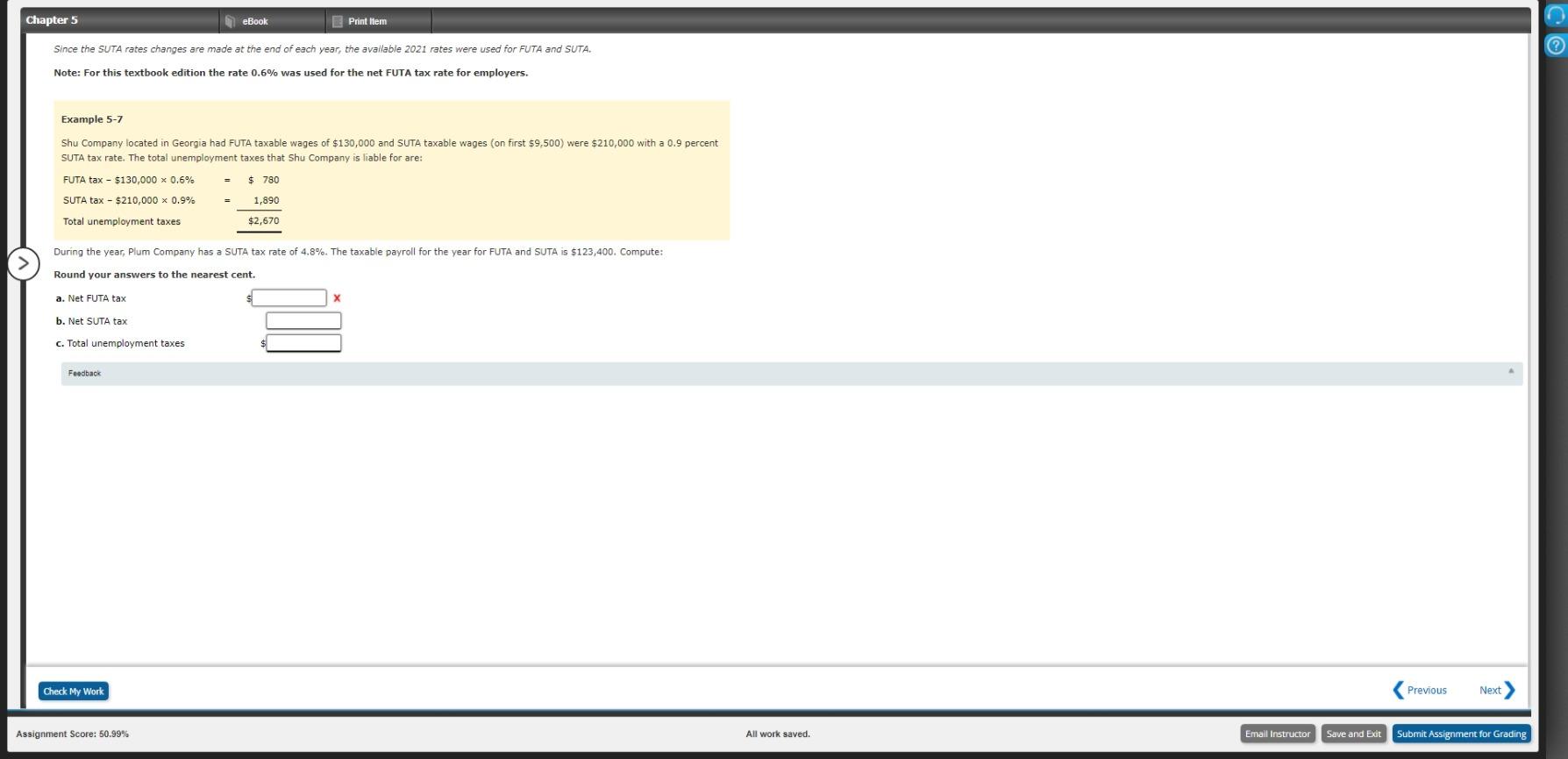

The FUTA tax applies to the first 7000 of.

. The new employer SUI tax rate remains at 34 for 2021. As a result of the ratio of the California UI Trust Fund and the total wages paid. Unemployment tax rates for experienced employers range from 01 percent to 54 percent and the tax rate for new employers is 27 percent the state said Dec.

The reserve ratio is the balance in an employers UI account premiums paid less. July 1 2020 to June 30 2021. FUTA Tax Rates and Taxable Wage Base Limit for 2022.

Most businesses also have to comply with their. The FUTA tax rate protection for 2021 is 6 as per the IRS standards. Section 96-92c Mail Date for Unemployment Tax.

Current and Recent Tax Rates by Industry. If an employer has no paid taxable payroll during the four-year period ending June 30th of the prior year they are assigned the maximum base tax rate of 62. 2021 Alternative earnings test amount for UI and TDI.

2021 Maximum Temporary Disability Insurance weekly benefit rate. 0010 10 or 700 per employee. UI Tax Rate for Beginning Employers.

2021 Base week amount. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. Taxable base tax rate.

24 new employer rate Special payroll tax offset. An employers tax rate determines how much the employer pays in. The best negative-rate class was assigned a rate of 1245 percent which when multiplied by the 46500 wage base results in a tax of 57892 while those in the worst rate class pay at the.

Payroll less than 500000. Generally employers who pay state unemployment tax on employees wages. Tennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates.

State unemployment tax rates. The maximum FUTA tax an employer must pay per employee per year is 420 7000 x 06. What is the SUTA tax rate for 2021.

This means that the employer. Employers are required to pay the Federal Unemployment Tax if they spend at least 1500 in wages during a single calendar quarter. Section 96-92b Minimum UI Tax Rate.

A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate effective for the coming calendar year. What is the Florida. Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee.

The FUTA tax rate is 6 of the first 7000 of wages though many businesses qualify for a tax credit that lowers it to 06. Section 96-92c Maximum UI Tax Rate. State SUTA new employer tax rate.

Current Tax Rate Filing Due Dates. July 1 2019 to June 30 2020. 10 rows New Employer Tax Rates.

Still it is only applied to the first 7000. Payroll greater than 500000.

940 Futa Suta Tax Rates For 2022 Form 940 Futa Credit Reduction States

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Unemployment Tax Rate Remains The Same For 2022 Nae

Minnesota Gov Tim Walz Signs New Law To Carry Over Unemployment Insurance Tax Rates Grand Forks Herald Grand Forks East Grand Forks News Weather Sports

View All Hr Employment Solutions Blogs Workforce Wise Blog

Payroll Tax Rates 2022 Guide Forbes Advisor

Solved Chapter 5 Ebook Print Item Since The Suta Rates Chegg Com

![]()

2022 Annual Tax Rate And Benefit Charge Information Division Of Unemployment Insurance

Business Owners Optimistic Following Increased Unemployment Tax Rate Wuft News

2021 Wage Cap Rises For Social Security Payroll Taxes

2022 Income Tax Brackets And The New Ideal Income

Many Struggling Oregon Businesses To See Tax Hike In 2021 Katu

Futa 2022 Futa Taxes And How To Calculate Them Nav

What Is The Suta Tax And Why Is It Going Up In 2021 Fourth

2022 Federal Payroll Tax Rates Abacus Payroll

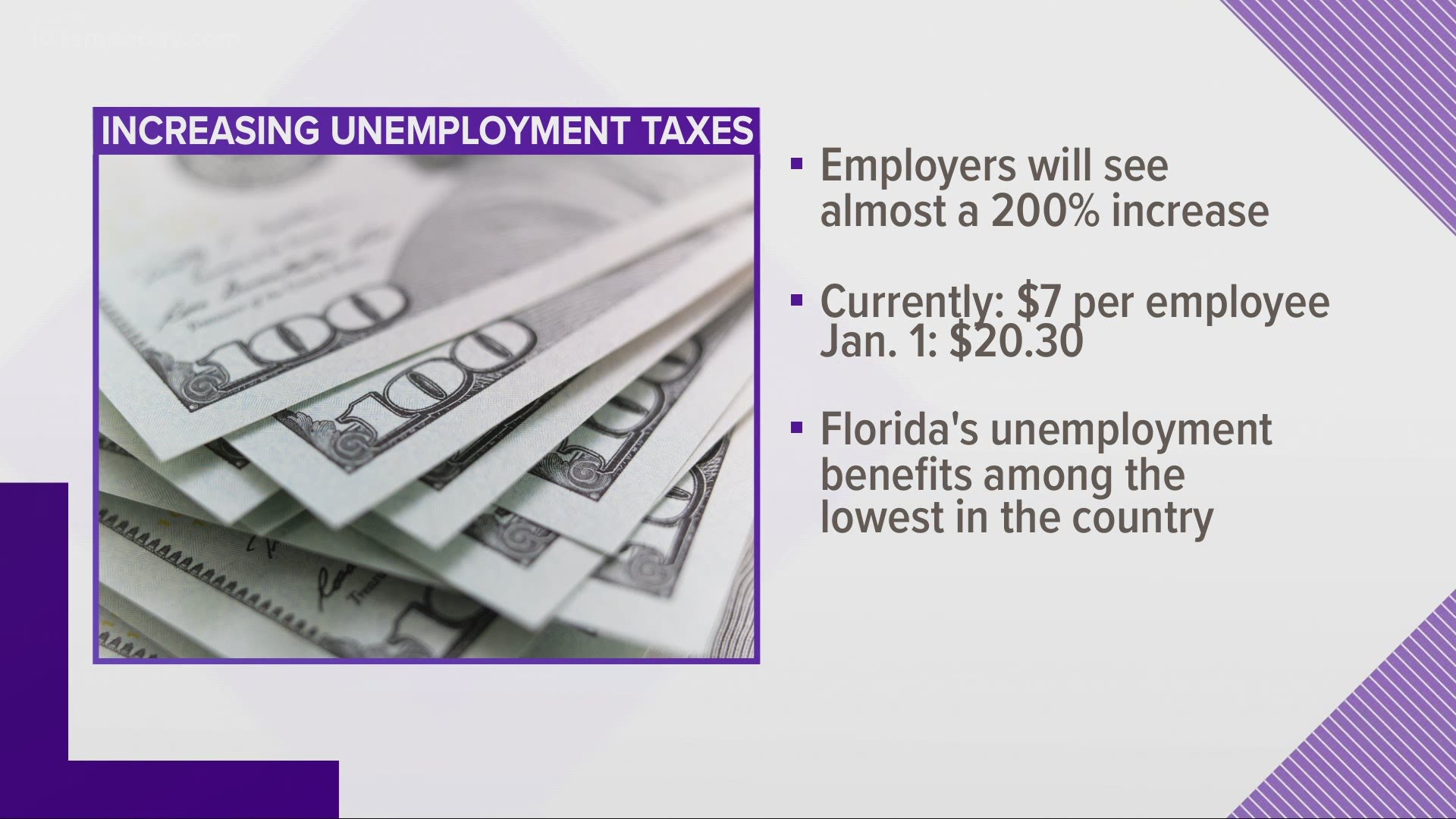

Unemployment Taxes On Businesses Will Increase In 2021 Florida Chamber Of Commerce Says Wtsp Com

Business Owners Optimistic Following Increased Unemployment Tax Rate Wuft News